Unpacking Ingenovis health‘s Debt Sheet: A Deep Dive into Financial Strategies and Industry Dynamics

Ingenovis Health, a prominent healthcare staffing and services provider, operates within a complex financial landscape. Understanding its debt sheet is crucial for stakeholders, including investors, employees, and industry analysts. This article aims to provide a comprehensive 3000-word analysis of Ingenovis Health’s debt structure, exploring its implications, the broader industry context, and potential future trajectories.

Before delving into Ingenovis’s financials, it’s essential to understand the dynamics of the healthcare staffing sector. This industry is characterized by:

Cyclical Demand: Fluctuations in healthcare demand, driven by factors like pandemics, seasonal illnesses, and demographic shifts, significantly impact staffing needs.

These factors contribute to the financial complexities faced by companies like Ingenovis Health, including the need to manage debt effectively.

Ingenovis Health has grown through a combination of organic expansion and strategic acquisitions. This growth strategy often involves leveraging debt to finance acquisitions and operational investments. Analysing the debt sheet requires looking at:

Total Debt: The aggregate amount of outstanding debt, including short-term and long-term liabilities.

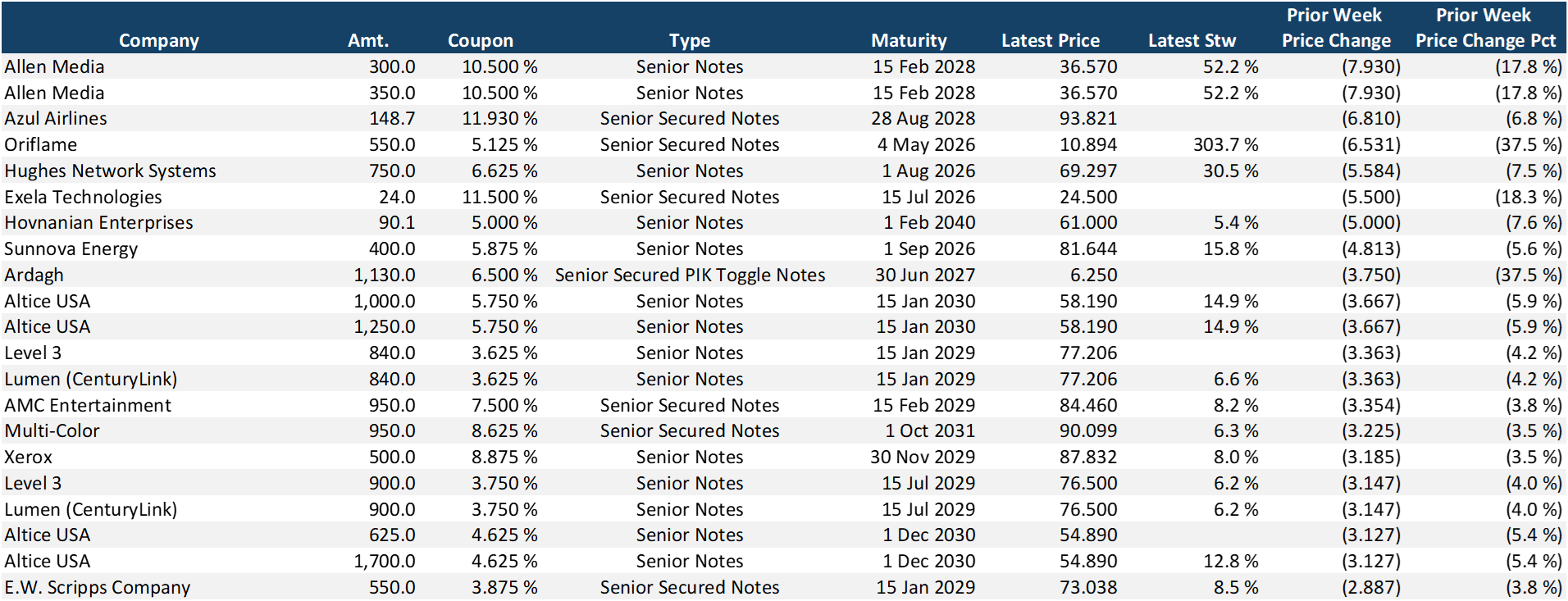

Analyzing the Composition of Debt

Ingenovis’s debt likely comprises various instruments, including:

Term Loans: Loans with fixed interest rates and maturity dates, often used to finance acquisitions.

The composition of debt reveals the company’s financing strategy and risk profile. Higher reliance on short-term debt may indicate greater vulnerability to interest rate fluctuations, while a significant proportion of long-term debt suggests a focus on long-term growth and stability.

Debt-to-Equity Ratio: A Measure of Leverage

The debt-to-equity ratio is a critical indicator of financial leverage. A high ratio suggests that the company relies heavily on debt financing, which can amplify returns during periods of growth but also increase financial risk during downturns.

A detailed analysis of Ingenovis’s debt-to-equity ratio over time can reveal trends in its financial leverage and risk appetite.

Interest Coverage Ratio: Assessing Debt Service Capacity

The interest coverage ratio measures a company’s ability to meet its interest obligations. A high ratio indicates that the company generates sufficient earnings to cover its interest expenses, while a low ratio suggests potential financial distress.

Analyzing the interest coverage ratio over time can reveal trends in the company’s debt service capacity.

Debt Maturity Profile: Managing Refinancing Risks

The debt maturity profile outlines the schedule of debt repayments. A concentration of debt maturing in a short period can create refinancing risks, particularly in volatile market conditions.

Analyzing the maturity profile can reveal potential refinancing needs and risks.

Ingenovis Health operates in a competitive landscape with other major healthcare staffing providers. Understanding the industry context is crucial for assessing the company’s financial performance and debt management strategies.

Factors Affecting Industry Debt Levels

Acquisition-Driven Growth: Many healthcare staffing companies have pursued growth through acquisitions, which often involve significant debt financing.

Competitive Analysis

Comparing Ingenovis’s debt sheet to those of its competitors can provide insights into its relative financial position and risk profile.

Analyzing key financial ratios, such as debt-to-equity and interest coverage, can reveal differences in financial leverage and debt service capacity.

Ingenovis Health’s debt management strategies will play a critical role in its future success. Several factors could impact its financial performance and debt profile:

Growth Strategies

Organic Expansion: Investing in talent acquisition, technology, and service expansion can drive organic growth and improve profitability.

Market Conditions

Healthcare Demand: Fluctuations in healthcare demand, driven by factors like pandemics and demographic shifts, can impact revenue and profitability.

Financial Strategies

Debt Restructuring: Refinancing existing debt at lower interest rates or extending maturities can improve debt service capacity.

Ingenovis Health’s debt sheet is a complex and dynamic element of its financial profile. Understanding its debt structure, industry context, and potential future trajectories is crucial for stakeholders. By carefully managing its debt and adapting to evolving market conditions, Ingenovis Health can position itself for sustained growth and success in the competitive healthcare staffing industry. Ongoing monitoring of key financial metrics, such as the debt-to-equity ratio, interest coverage ratio, and debt maturity profile, will be essential for assessing the company’s financial health and risk management strategies. The healthcare staffing industry will continue to evolve, and Ingenovis Health’s ability to navigate these changes while maintaining a healthy financial position will be a key determinant of its long-term success.

:max_bytes(150000):strip_icc()/EW-Meal-Plans-Healthy-Weight-Gain-Day-4-1x1-alt-81577102cff74485ac146541976d8b22.jpg?resize=200,135&ssl=1)